Meta’s $2 Billion Manus AI Acquisition Faces New Scrutiny from Chinese Regulators

The world’s social media giant just made one of its biggest bets ever on artificial intelligence, but the path to integration is proving more complicated than expected.

In a landmark move at the close of 2025, Meta announced its acquisition of the cutting-edge AI startup Manus for a deal valued at over $2 billion. This acquisition ranks as one of Meta’s most significant AI-focused purchases.

The deal, however, has swiftly moved from a business story to a geopolitical one. On January 8, 2026, China’s Ministry of Commerce announced it would launch an assessment of the acquisition, scrutinizing its compliance with Chinese laws on technology export and cross-border data.

This regulatory intervention introduces significant complexity into Meta’s plan to integrate Manus’s “general AI agent” technology across its family of apps, including WhatsApp, Instagram, and Facebook.

01 The Deal and the Prize: Why Manus Was Worth Billions

Meta’s acquisition of Manus represents a fundamental strategic pivot. Industry analysts note that the AI race is evolving beyond simply building larger models to a new phase focused on practical application and deployment. Manus, founded in 2022, had mastered this exact challenge.

Unlike a standard chatbot, Manus’s technology is a “general AI agent“—a system that can autonomously understand complex goals, break them down into steps, and execute them by using software tools. This allows it to complete tasks like market research, code generation, and data analysis, delivering finished results instead of just suggestions.

Key Metrics of Manus’s Meteoric Rise

The company’s explosive commercial traction is what made Manus a “scarce asset” in Meta’s eyes. The startup had not only developed breakthrough technology but had also proven that businesses were willing to pay for it at scale.

02 A Geopolitical Tangle: From Chinese Roots to Singaporean Exit

The regulatory scrutiny from China stems from Manus’s origins. The company was founded by a Chinese team and initially operated from China. In mid-2025, ahead of the acquisition talks, Manus executed a decisive operational shift.

It moved its global headquarters to Singapore, dramatically reduced its Chinese workforce, and shifted its operational focus overseas. Meta has stated that the acquisition structure “eliminates any ongoing Chinese ownership” and that Manus will cease all operations in China upon the deal’s completion.

Despite these efforts, Chinese regulators are now examining whether the transfer of Manus’s technology and intellectual property to a U.S. entity complies with China’s laws on technology export and data transfers abroad. Experts point out that core technology may have been developed on Chinese soil, bringing it under China’s regulatory purview.

03 Meta’s Strategic Play: Weaving AI Agents into the Social Fabric

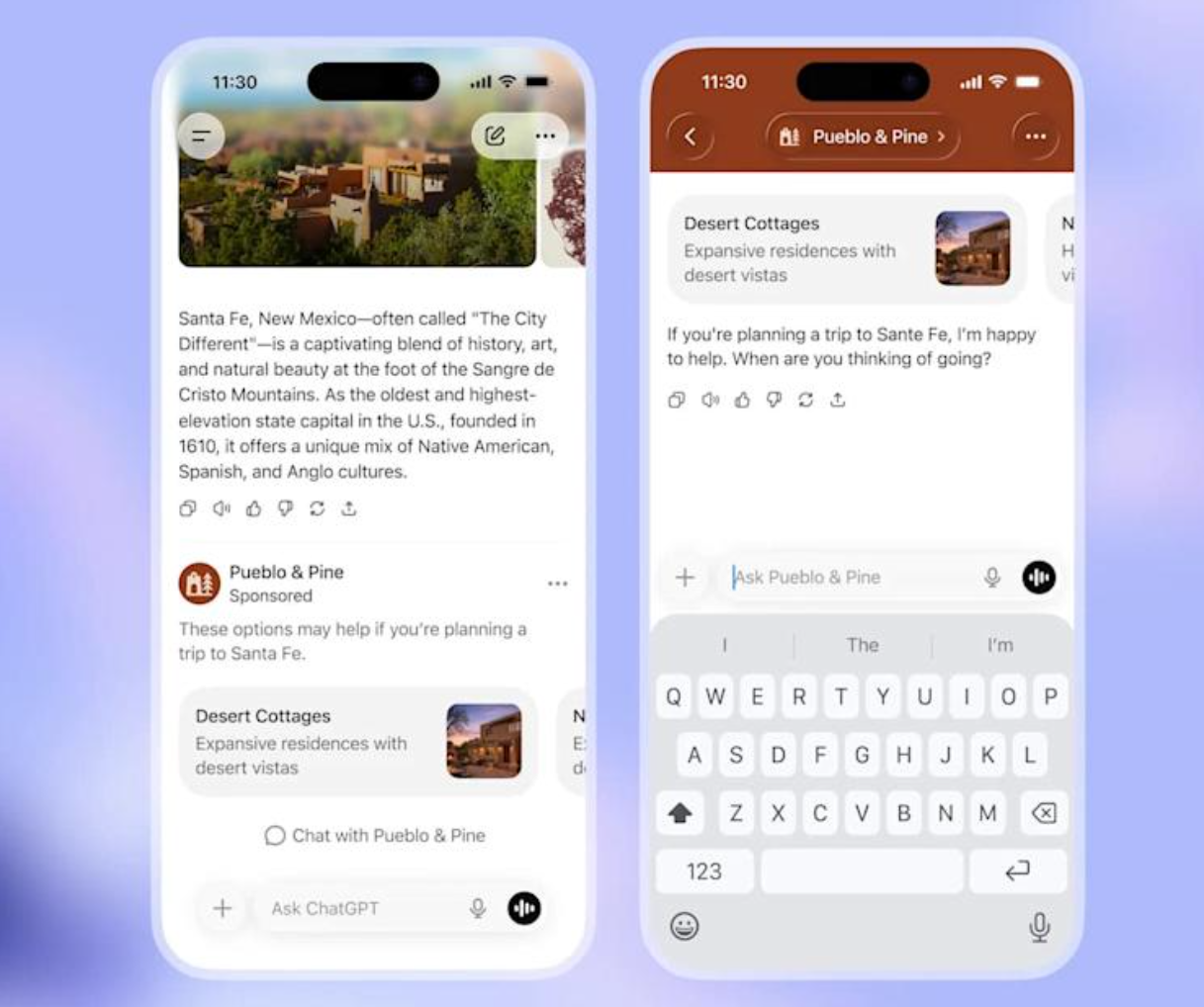

For Meta, the appeal is clear. The company plans to embed Manus’s agent engine directly into its massive platforms. The potential applications are vast:

In WhatsApp & Messenger: AI agents could handle complex customer service tasks, change flight bookings, or plan trips, only escalating to a human when uncertain.

On Instagram: Agents could power shop inquiries, recommend products, and complete purchases within chat.

For Advertisers: The technology could automate campaign creation, budget management, and performance optimization.

The ultimate goal is to make Meta’s messaging apps the default place where users go not just to talk, but to get things done. This transforms them from social utilities into indispensable productivity and commercial platforms.

04 Industry Implications and a Warning to Rivals

The acquisition sends a powerful signal to the entire tech industry and has forced competitors to sharpen their own “agent” strategies.

Microsoft, with its Copilot deeply integrated into Office, lacks Meta’s direct reach to billions of consumers. Google is pushing its Gemini model, but building credible commercial agents within products like YouTube remains a work in progress. For Meta, the bet is that its unparalleled distribution and user engagement will be the decisive advantage in the AI agent race.

The deal is also a watershed moment for AI startups, particularly those with Chinese founding teams. It demonstrates a potential exit pathway—relocating to a neutral hub like Singapore to navigate geopolitical tensions and attract global giants. However, China’s newly announced review serves as a stark reminder that such paths are fraught with regulatory risk.

As one industry report framed it, the Meta-Manus deal marks the moment AI competition shifted from “competing on model parameters” to “competing on application landing“.

The story is no longer about which company has the smartest AI in the lab, but about which one can most effectively put it to work in the real world. Meta has placed a multi-billion dollar bet on Manus to lead that charge, but first, it must successfully navigate the complex geopolitical landscape the deal has uncovered.

Related posts